By Patrick Kagenda

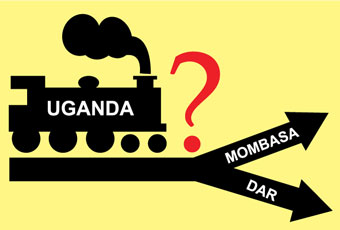

US gives Shs 1.8 trillion for rail link from Dar to Kigali

Businessmen and women importing and exporting goods into Uganda often complain about high taxes. But they complain more about the high cost of transport. They say transport costs are the single leading cause of high prices of goods in Uganda.

A 17-ton truck charges US $ 5000(Shs 9.7million) from Mombasa to Kampala or US $ 294.1(Shs 550,000) per ton.

With bad roads and the new axle-load restriction imposed by the government of Kenya late last year, transport costs have soared.

The government has advised business people to shift from importing through Mombasa to Dar-es-Salaam.

But Kasim Omar, the chairman of the Uganda Clearing and Forwarding Agents (UCFA) says they can only use that route when there are glitches on the Mombasa route.

‘The Dar route is a long journey and wouldn’t make profit,’ he says, ‘It is only beneficial to exporters.’

But that could change soon.

The Tanzanian government and other southern Africa countries are implementing long-term plans to make the Dar route, also called the Central Corridor route, of rail and road attractive to importers and exporters to the east and southern Africa countries of Uganda, Rwanda, Burundi, DR Congo, and South Sudan.

The central corridor has been redundant and it is only recently, after the restrictions at Mombasa port that the business community is opening up to the central corridor.

A road and rail network is planned to link up with the Tanzania-Zambia network to Angola on the south west coast of Africa.

Burundi and Rwanda are planning to complete, in four years, a 500 km road linking them with Tanzania.

The US$ 688 million (Shs 1.3 trillion) project is expected to be funded by the African Development Bank, the World Bank, European Union, China and Saudi Arabia.

But the main attraction, according to the planners will be the wider standard gauge rail that should speed up trains and allow more cargo haulage.

At the centre of the new plan, is the Dar port.

Apart from the derelict road and rail links to the port, the planners have to tackle a stiff congestion problem.

The Dar port has 11 berths as compared to 19 berths at Mombasa.

Recently, up to 5,332 containers were piled up at the port. The Tanzania Revenue Authority (TRA) had to remove some of the bureaucracy blamed for delays in cargo clearing in a bid to clear at least 200 containers daily. The Dar port handled more than 350,000 20-foot equivalent units (TEUs) last year, well over the 250,000 TEUs it was designed for.

The number of containers transiting Tanzania is expected to climb by as much as 1,200 % or about 3 million TEUs in the next 20 years.

The only attraction at Dar-Es-Salaam is the standard tariffs. Both the low contained loads and the uncontained loads have uniform tariffs.

The Tanzanian government plans two new ports on the Indian Ocean coast at Bagamoyo and Tanga. Other ports are at Tanga and Mtwara in the southeast of the country.

Tanzania has already secured US$943,000 from the American government to revamp its 1,000 km central railway line from Dar es Salaam to Isaka in the Shinyanga region. Burlington Northern Santa Fe Railway Company of America is to undertake the project. If linked to the Rwandese capital, Kigali, the rail would be the shortest route. The Dar-es-Salaam- Mwanza-Port Bell is 1,581 Kms.

The Dar-Kigali line is planned to use the modern standard gauge rail to increase the speed and tonnage of cargo hauled to the DR Congo, Rwanda and Burundi.

There is already a 480km tarmac Isaka-Lusahunga road.

The improved rail link, road, and the Tanzania-Zambia Railway operation should greatly ease access to the Southern Africa interior.

Sensing competition, Kenya has its own plans for a road connecting to South Sudan through South Turkana National reserve, Lagpotpot, Kopoeta, Torit, and Ngangala up to Juba.

It plans a second major port on the Indian Ocean at Lamu.

Together with Uganda, it is also planning a modern standard gauge railway network from Mombasa to Kampala to replace the current rail which, after 100 years of service and poor maintenance, has outlived its usefulness.

Uganda hopes to hook onto the new rail project from Kenya at Tororo, in eastern Uganda, with a rail tracing the route of the abandoned northern link to Gulu and stretch it up to Juba. According to Uganda’s Works minister John Byabagambi, the Japanese government has expressed interest in the rail line project.

Uganda is also planning to revive the Kampala-Kasese line and also connect to Rwanda and Eastern DR Congo.

Currently, eastern DR Congo and Southern Sudan use Uganda as a shorter route for them to transit their cargo.

Developments in the regional rail sector have gained momentum since the Kenya and Uganda governments hit a rock with a sour concession deal with Rift Valley Railways three years ago which has now degenerated into a legal battle.

‘Whether RVR hides under the law or not, they will have to go, because they have failed to meet our expectations as per the concession agreement,’ minister Byabagambi said in an interview.

Failure of RVR’s concession has stalled various funding projects including loans from the Germany Development Bank (KfW) and International Finance Corporation (IFC) the private lending arm of the World Bank.

Experts in regional affairs are pointing at the Chinese as the new likely financiers for the rail because of their growing economic influence in the region.

Chinese are currently involved in rail and road construction and mining in the DRC and in Oil extraction in Sudan and are looking at the new rail as a solution to their quick access to the sea.

Uganda hopes that the current rail and road network, also called the Northern Corridor, remains the most viable route to the sea.

It is the shortest route to the Indian Ocean for both Eastern and Central African nations and turn around time for a train from Kampala running at 80Kms assuming there are no speed limits is one day as compared to the same for the central corridor that would take 4 days to reach the port of Dar-es-salaam.

The fear is that although cargo which transits through Uganda is a very small percentage, if Rwanda, Burundi, the DRC and Southern Sudan stopped cargo transits through Uganda it would hurt the economy.

A transit license costs Shs 300,000 a year per transit cargo truck going through Uganda. Statistics from Uganda clearing and forwarding agents indicate that between 400,000-700,000 Transit Entry Units (TEU`S) to the hinterland passed through Uganda last year. Most of this traffic was from the port of Mombasa and not Dar-Es-Salaam.

Cargo through Mombasa includes all cargo going to Rwanda, Burundi, DRC, South Sudan and Uganda. The journey from Dar-Es-Salaam to Kampala is over 1,629 kms while it is 820Kms from Mombasa to Kampala.

Experts say, Uganda needs to be prepared for a change in this trade configuration.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price