Kampala, Uganda | THE INDEPENDENT | The Uganda shilling has come under pressure against the dollar as people go into panic buying of dollars due to coronavirus.

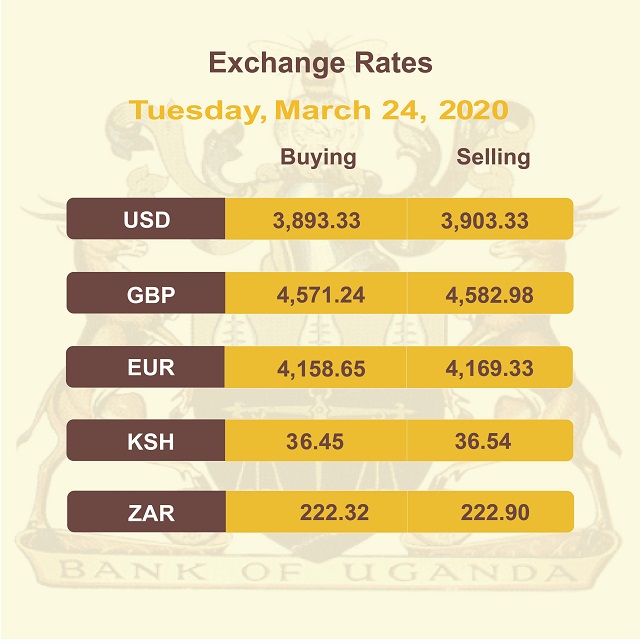

On Tuesday, March 24, the Bank of Uganda quoted the shilling at Shs 3,893/3,903 buying and selling respectively against the dollar. This is far weaker than a week ago when the local currency traded at Shs 3,741/50 against the dollar.

This means the Uganda shilling has shed Shs 150 of its value in less than a week.

Dealers have said organisations and individuals are just in the market buying every dollar they can lay their hands on in anticipation of shortages because of coronavirus.

Stephen Kaboyo, the managing director of Alpha Capital Partners, said on Tuesday that “the anxiety hovering over the markets is just increasing by the hour. Everyone is positioning in haven assets and this aggravating the selloff.”

The outbreak of coronavirus, with Uganda confirming nine cases so far, has shutdown businesses with people being advised to stay home. Traders who take exports and bring in dollars are not working. Other sources like tourism are having their worst run in a long time.

Most countries have shutdown business operations which means that Ugandans working abroad are also not working to be able to send in money in the form of diaspora remittances.

Paul Lakuma, researcher and expert foreign exchange forecaster at Economic Policy Research Centre (EPRC), said the depreciation is a sign of scarcity of dollars in the market and that pumping in more foreign currency can help.

This can be done by the Bank of Uganda by using foreign reserves. However, Lakuma advises it could be “too early to do that. I would advise that we wait. Things may worsen.”

Last week, pressure on the shilling had started with Kaboyo noting market swung into a panic mode driven by the uncertainty over the potential economic fallout of the Corona pandemic.

Bank of Uganda pumped some dollars in the market but did little to tame the sharp losses, according to Kaboyo. The US dollar is the most used currency for business in the world.

A weak currency makes imports expensive as traders need more money to buy dollars to be able to order for products. This can lead to rises in the prices of goods and services.

******

URN

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price