Financial sector cautious optimism

However, as one man’s meat is another’s poison, some business leaders, especially in the insurance and banking sectors are more optimistic about the potential returns from government’s investments in the oil and gas industry and anticipated recovery of private sector credit.

Among them is Miriam Magala, chief executive officer of the Uganda Insurer’s Association, who says investments in the oil and gas industry will boost the insurance industry.

The insurance industry is betting on substantial windfalls from underwriting of oil and gas risks- under the new Oil and Gas Co-Insurance Syndicate- which consists of 17 local insurance firms that have agreed to pull resources together to tap into the expensive sector.

Government plans massive investments in oil and gas infrastructure over the next few years, including a refinery, pipeline, roads, and others, ahead of planned oil production by 2020.

“We are fairly optimistic, but with a view that further interventions are needed to lift the economy,” said Allan Muhinda of Stanbic Bank. “Our optimism is driven by anticipated full recovery of credit growth in the medium term underpinned by monetary policy easing.”

Stanbic is also looking out for local content initiatives to support local business participation in prospective infrastructure projects, and resources for resettlement of arrears.

However, Stanbic’s optimism is also tempered by anxiety over government’s poor record of execution of infrastructure projects, evidenced by successive extensions of expected production timelines for oil, and delays in completion of road and energy projects.

“Execution really determines how much marginal growth we can expect from the investments we make today,” Muhinda said.

Like Karuhanga, Muhinda was also worried about increased debt versus reduced growth aspirations. “Specifically, increased domestic debt is likely to pose challenges to private sector growth,” he said.

“At Shs2.7 trillion, arrears are about 2.8% of GDP. It’s critical to have a sustainable approach to expeditiously reduce arrears because they have a knock-on effect on the quality of private sector credit. It is even more important to formulate guidelines for preventing further accumulation of these arrears,” he said.

He is also worried about increased taxes targeting a limited formal sector, that is; “incremental tax measures within the formal sector, especially within key transformational sectors such as technology, banking and agriculture, without refining or consolidating the tax net to capture more informal activity.”

Executive Director of the Private Sector Foundation of Uganda, Gideon Badagawa, said he is optimistic that issues are being addressed to support private sector competitiveness and economic growth, including job creation, increased production and incomes, and export sector growth.

“I notice ample focus on building infrastructure, supporting productivity for non-traditional exports, building skills, energy investments, oil and gas, as well as support for ICT development,” Badagawa said.

“These are important in supporting the private sector to drive growth,” he said. “The challenge I see is shortage of measures to strengthen agricultural value chains to deliver growth, for example laxity in support towards developing farmer groups, provision of extension services, support for post-harvest handling.”

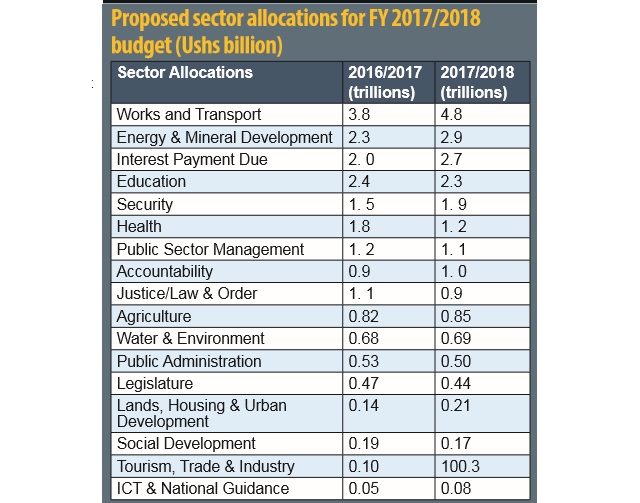

Agriculture employs up to 75% of Uganda’s population, yet receives less than 4% of the budget allocation, and as a consequence, has been in steady decline over the past decade. This is far short of the 2003 Maputo Declaration, which Uganda signed and committed to allocate 10% of its total budget to agriculture.

“The argument by government that investments in roads and other infrastructure is intended to facilitate agriculture markets is not convincing when core elements of the sector responsible for production, like irrigation, extension services, construction of silos, seeds, that require more direct funding, are neglected,” said Everest Kayondo, chairman of Kampala City Traders Association (KACITA)

Excessive spending on unproductive sectors is also a major concern for the private sector;

“The challenge of the coming budget though, like has been in the previous ones, is to rescue careless spending and focus more on sectors that create wealth and employment, especially agriculture, manufacturing, tourism, ICT,” Badagawa said.

“We are also not comfortable with a huge consumption budget going towards paying salaries of very many Members of Parliament, big cabinet and civil servants in new districts. These administration costs must be cut. We believe more funding should go towards capital expenditure that supports economic activities.”

Ismail Sekandi, a hotelier and executive council member of Uganda Hotel Owners Association (UHOA) said he is worried that the government continued to neglect the tourism sector.

“Our budget has over the years not paid much attention to the core areas of the hospitality industry. We continue to ask for practical solutions to the problems relating to gaps in personnel training and high taxes. Uganda Tourism Board has a budget of US$3 million to market our tourist potential as opposed to Kenya Tourism Board that is allocated over US$30 million. Many people still do not know much about Uganda. Local tourism needs to be given attention through product innovation,” he said.

Kayondo also raised concern about the lack of a national airline; “We do not have a national carrier at the moment which we think would serve this purpose [of promoting Uganda’s tourism]. We have seen our neighbors Rwanda recording successes in this area using RwandAir.”

It is disturbing to the business community that most of these issues sound so familiar: “The issues we have been raising before are the ones that keep coming back. We have argued that we need an all-inclusive or pro-people budget that is linked to the objectives of sustainable development goals (SDGs),” Kayondo said.

Perhaps Kasaija has an ace up his sleeve to calm the anxieties of the business community. If not, companies need to buckle up and prepare for yet another turbulent year.

****

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price

for sure its not fair. to funds infrustructures on expence of investors.

Yes they are the ones who are going to use those roads … so with me i dont see any prob with funding infrastructure,

Raw materials will jave to be transported, Finished goods will also require to be transported to market areas .

Am just an extra ordinary Ugandan but am not pleased with the budget for two reasons ,

1_how can a fell brother in butambala benefits from the budget as the first resource full farming is not put on board,

2_budget would have been fair if all the targeted plans are put in their allocations , so that we suffer now and the next generation don’t suffer alot.

I really don’t think these debts will ever be paid. As the current government only caters for its needs not thinking about the future generation. There are also statements like, ” Uganda wants to be transformed to a middle income country” My question is ” How?”

Uganda is good in paper writing and coming up with theoretical ideas yet practically we no where.am still perturbed how we will raise the 14 trillion domestically or we just going to shift that burden to the grass root person who cant afford to leave a life of value yet the policy makers are exempted from paying taxes.

Its completely unrealistic to come up with such a budget which priotizes infrastructure without focusing on the short term income generating projects because you cannot talk about uganda reaching the middle income status in 2021 when huge sums of money are being missallocated to areas that can not yield immediate income to the nation.For sure there are lots of issues to watch out in this budget that need critical attention.

slowly slowly things will be very ok……God has aplan for uganda only that we dnt pray we just say. lets pray u never He will hear us . be blessed