URA to collect Shs16.3tnas experts worry about some proposed taxes

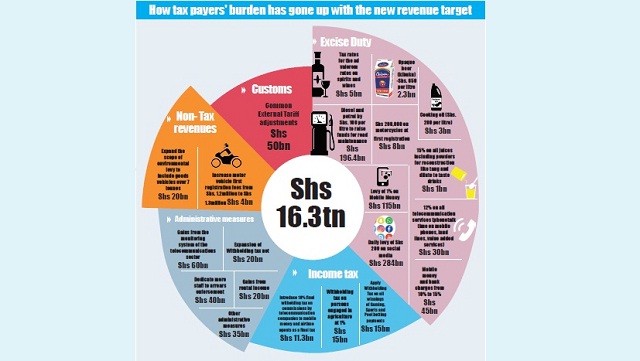

Kampala, Uganda | ISAAC KHISA | Newly proposed taxes and enhanced revenue collection measures could help the taxman collect an additional Shs1.9trillion to hit the new Shs16.3trillion revenue target.

The government has tasked the Uganda Revenue Authority (URA) to collect more money in the new financial year that startson July 1 to meet its debt obligation and finance ongoing infrastructure development projects.

Tax experts who spoke to The Independentduring the post budget analysis said there are chances forURAto hit the new targetciting new taxes.

“In the FY2017/18the government gave URA a very high target but there were no major taxes introduced however this time aroundmore taxes have been introduced,” said John Jet Tusabe, a tax manager at a tax advisory firm, KPMG.

For instance, he said if they (government) go ahead to implement the proposed newtaxes on social media and mobile money efficiently, it is possible that they could meet the new target.

The government effective next month plans to levy Shs200 for whoever uses social media per day to raise Shs284bn. It also plans to levy 1% on mobile money transfer to raise Shs115bn as well as increase excise duty on mobile money and bank charges from 10% to 15% aimed at raising Shs45bn.

The performance of the economy, however, willhave to play a part towards URA’s attainment of its tax revenue target, Tusabe said.

“If government, for instance, comes up with measures that are a disincentive to economic activities, then, there is no way URA will meet the set target,” he said.

Government officials predict that the economy will grow by 5.8% in the new financial year, higher than the performance of 3.9% last year [FY2016/17]as a result of continuous investment in security and infrastructure development projects.

Francis Kamulegeya, the senior partner at PwC Uganda and a member of the PwC Africa governance board agrees with Tusabe’s view that the taxman could hit the new target.

He said the cocktails of taxes, though some ill-informed, could enable URA to collect more revenue and hit its target.

“I think they (URA) will collect money because of the various taxes they have come up with, though there are a number of taxes that are ill-informed, punitive and not the right policy in this kind of economy,” he told NTV on June 13.

This was in reference to the newly introduced 1% excise duty on mobile money. Of recent, mobile money has been praised for promoting financial inclusion given its strong penetration and the ease with which the population accesses money transfer services with telecom firms.

Data from Bank of Uganda (BoU) shows that mobile money users have increased to more than 19million customers since mobile money was introduced nearly nine years ago while the value of transactions has increased from merely Shs490million in March 2009 to Shs4.96trillion in March 2017.

On the other hand, the country’s combined 25 commercial banks have close to 8 million accounts, with some customers holding multiple accounts.

Behind new tax proposals

Government has suggested new taxes and a higher target for URA in a bid to meet its expenditure on debt repayment and infrastructuredevelopment projects.

However, this FY2017/18, it is projected that the tax body will record close to Shs700bn as revenue shortfall. Its target is Shs15.03trillion.

URA has in the past years been given higher revenue targets but failed to hit them in the past three years due to bad economic situations coupled with limited capacity for its human resource and related factors.

Beyond the URA target, government plansto spend Shs32trillion in the new financial yearcompared with Shs29trillion for FY2017/18 amidst talks of lack of accountability.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price