The ministry of finance, planning and economic development is banking its revenue increase on the projected 6% growth of the economy, stable inflation estimated at 4.3%, stable exchange rate and enhanced tax compliance.

It also hopes that the proposed adjustments in some tax rates will widen the tax base and enhance compliance. It also hopes that the proposed technical amendments to tax laws will minimise unnecessary disputes between taxpayers and URA.

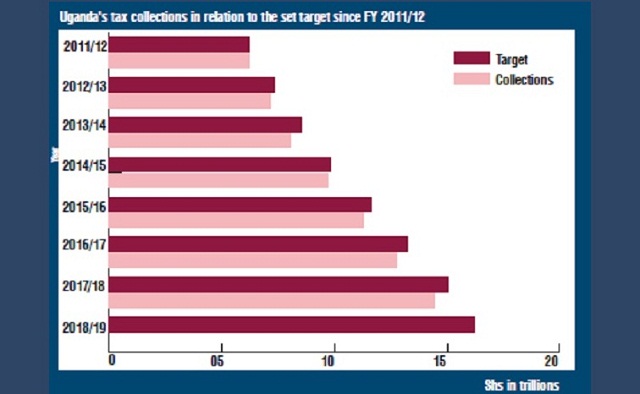

Finance minister, Matia Kasaija, said the new tax revenue target will raise the ratio of revenue-to-GDP from 14.2% to 14.6% though still less than Rwanda’s 16.7%, Kenya’s 18.4% and Tunisia’s 30.3%.

“Uganda’s tax revenue effort at 14% of GDP remains low and inadequate to finance our development needs,” he said adding, “Accordingly the domestic revenue mobilisation strategy will address policy, technical and administrative issues in enhancing tax and non-tax revenue collection.”

He said this strategy will be completed in September to guide implementation in Financial Year 2019/20.

However, Kasaija noted tax evasion remains one of the biggest hindrances to achieve high revenue collections.

“For example, about 30% of eligible Value Added Tax is not collected, translating into a loss of about 4% of tax toGross Domestic Product,” he said during the Budget Speech at the Kampala Serena Hotel on June 14.

“VAT evasion involves the fraudulent use of non-existent transactions claiming input tax against purchases and expenses that were not incurred, and issuance of invoices for business transactions for which there is no genuine supply or movement of goods and services,” he explained.

On a positive note, Kasaija revealed that URA has, so far, recovered Shs605 billion from companies evading tax. In addition, about 2,100 companiesare undergoinga comprehensive review to determine the liabilities not yet paid.

Other measures for dealing with tax cheats, he said, include cancellation of the tax registrationand revocationof all Tax Clearance Certificates issued to the taxpayers involved including blacklisting them from Public Procurement and Disposal of Public Assets Authority (PPDA) sdeals.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price