Its narrative is that one of these days, the Uganda government might fail to repay money borrowed from China and China will seize some national assets that were offered as collateral to the Export Import (Exim) Bank of China.

Talk of China grabbing Uganda assets is also fuelled by stories elsewhere; from Djibouti, Kenya, Zambia, Sri Lanka, Pakistan, and others. In all cases, the Chinese have denied any asset grabs.

In Zambia it was claimed that China was taking over the state power company to recover its money. In Sri Lanka in 2017, the Chinese actually took over a strategic port. The American magazine `Foreign Policy’ said Djibouti’s China-driven debt could soon hit 88% of the country’s GDP. In December last year, reports emerged that Kenya had offered parts of Mombasa Port as collateral for financing its $3 billion railway. In August 2018, Malaysia cancelled three Chinese-backed multi-billion infrastructure projects because the ballooning $250 billion debt.

But at a press conference on Jan.08, Kasaija attempted to alley the fear that China could grab Ugandan assets.

He told journalists that most of Uganda’s debt has been provided multilateral creditors on concessional terms. They include banks the World Bank, African Development Bank, and Islamic Development Bank and others who offer relatively low interest rates below 1.5 per cent annually – which is almost interest free money. They also often include a grant element of more than 50 percent, long maturity periods averaging 35 years, and a grace period before repayment starts of not less than six years.

ESCROW ACCOUNT BALANCES AS AT 30.06.2018

| Account Name | Account No. | Ccy | Amount (USD) | Ugx. Equivalent |

| National Backbone & E- Gov’t Project Phase 111 Repatment Reserve Account | 9030012334027 | USD | 311,037.19 | 1,206,746,537.90 |

| Mofped / kampala – Entebbe Airport Expressway Escrow | 9030012338545 | USD | 7,116,816.11 | 27,611,467,302.77 |

| Mfped/ Isimba Hydropower project – Escrow Account | 9030010820439 | USD | 9,693,126.39 | 37,606,907,111.60 |

| MIN. OF FIN 7& ECON DEVT.CIVIL AVIATION AUTHORITY PROJECT ESCROW ACCOUNT | 9030012334086 | USD | 4,013,380.44 | 15,570,912,762.09 |

| Karuma Hydro Power Project Escrow | USD | 17,638,956.42 | 68,434,741,170.50 | |

| Total | 38,773,316.55 | 150,430,774,884.86 |

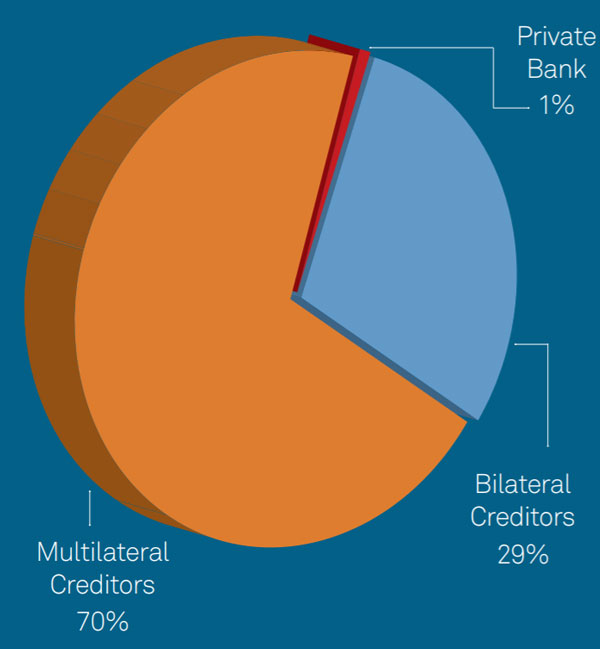

According to official Ministry of Finance figures, as of June 30, 2018, multilateral lenders accounted for 68% of Uganda’s debt, bilateral creditors 31%, and commercial banks only one per cent of external debt. Uganda’s domestic debt, which comprises 33% of total debt, is mostly borrowed from local commercial banks.

Kasaija said bilateral creditors like China’s Exim Bank and the Japan International Corporation Agency (JICA) offer preferential terms, including a grant element of between 20 and 35%. He did not mention the interest rate but these are sometimes as low as 2%.

“China taking over assets in Uganda?” Kasaija said, “I’m not worried about China taking assets.”

This appears to be contrary to Kasaija’s position in the letter to Museveni. In the letter, he says national assets are at risk.

“Given what is happening in our peer countries as regards to China debt,” he says, “we strongly believe we should protect our assets from possible takeover.”

Project management experts also say China debt is expensive because it inflates the total cost of the projects.

“Many Chinese companies can bid for a job but they are all owned by one entity; the Chinese government,” one source said, “So they can agree to offer the cheapest kilometer of road, for example, at US$1.2 million when the open market rate is US$800,000.”

Debating debt ratios

Fear of China has led to growing concern about Uganda’s public debt generally. According to the `Debt Sustainability Analysis Report 2016/17’ published in December 2017 by the Ministry of Finance, total public debt by June 2017 was US$9.4 billion. Foreign debt was US$6.2 billion, and Domestic debt in foreign currency terms US$3.2 billion.

At that point, the value Uganda’s export of goods and services was US$6.4 billion and debt service payments were US$209 million ($144 million principle plus $70 million interest) giving a Debt Service Ratio of 3.7%. The ratio lies between 0 – 20% for most countries. The Debt Service Ratio is the most important measure of debt sustainability because it shows ability to pay. That means Uganda was in a good position at the time.

Based on this, the government projected to increase nominal public debt from 37% of GDP in FY2016/17 to 40.2% in FY2017/18, before peaking at 47.8% in FY2020/21. The present value of total public debt was projected to follow a similar trend, increasing from 27.1% in FY2016/17 to peak at 35.1% in FY2021/22.

But two other ratios that have dominated debate of the debt are the Debt to GDP ratio and the Debt to Revenue ratio.

Uganda’s debt to GDP ratio of 41 per cent is still below the International Monetary Fund (IMF) risky threshold of 50 per cent and compares well with other East African countries. But the Office of the Auditor General has said the Debt payment to national revenue collected ratio is bad. He said at 54%, it is the highest in the region.

According to AG Muwanga, interest payments on domestic and external debt during the financial year 2017/2018 were Shs2.34 trillion, which is 17% of total revenue collections, which is above the limit of 15% set in Public Debt Management Framework of 2013.

The Debt to GDP thresholds are based on a World Bank study that found that if the ratio exceeds a certain percentage for an extended period of time, it slows economic growth. The threshold differs based on the level of the economy. For developed economies, it is 77%, so-called emerging markets 64%, and less developed economies 50%. Every percentage point of debt above this level costs the country about 2% in economic growth, according to the World Bank. However, this does not mean the country automatically is in debt distress.

In the third quarter 2018, the U.S. debt-to-GDP ratio was 99%. Japan’s debt-to-GDP ratio last year was 228%. But Japan was obviously very able to pay its public debt.

In 1989, according to a World Bank report entitled `From Crisis to Sustainable Growth’ the Debt-to-GDP of Sub-saharan Africa was 100%. Debt service to exports ratio was 47%.

Kasaija said Uganda’s public debt, both domestic and external is $10.7 billion (equivalent to Shs41.326 trillion) as of end of June 2018.

The debt-to-GDP ratio is 41% and debt-to-exports is 3.27%. Based on these figures, it appears, Uganda is in a good position to pay its creditors as obligations fall due. And, according to the `Debt Sustainability Analysis Report 2016/17’, the managers of the economy are putting in place measures to manage the debt, including improving implementation of projects for which money is borrowed. That should, hopefully, ensure that China does not grab any Ugandan assets.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price

I hope what am reading is FALSE. Because If our treasured assets, that God gave us become taken, then what is the essence of the loan. Where is the justification for the Loan?, and what will the future generations call Us?. We are meant to be smarter and we should be having a projection that after say 100 years, we will be at a developed, date free, self sustaining with ability to even give loans to other countries.

well we r looking at the present as ugandans not at the future i live abroad but here where i live these pipo have developed in term of construction roads railylines infrastructure but they too u here the loan is gonna paid in 50 yrs but remember the chineses r not going to take away our roads our buildings it will still stay in our country and the worst part is ugandans r looking up to m7 hes gonna leave and all will stay comeon ugandans

I do not think for one moment, going by your remarks, that you understand what this article is about.

Wherever it is you live abroad, please stay there peacefully and enjoy your stay, these things are way above your pay grade.

I think today beholds the future what’s the use of the roads when our historic sites are controlled by another state this only takes us back to the colonial times and Amin’s move to chase the Indians if we accept such loans in desire for infrastructure we are laying tough times for our children hope you can see this fellow Ugandans

We putting in national assets as collateral security while getting the loans isn’t a good idea at all because according to the way I see our dear country Uganda, the current state of our economy isn’t that pleasing. So shall we be working only to repay debts, and certainly we might fail to pay that debt meaning our country will cease to be our own and belong to foreigners instead just because we borrowed printed paper valued as money. Let our leaders think beyond their noses otherwise ‘ pearl of Africa’ is headed for doomsday….

Nín xūyào shāngyè dàikuǎn, gèrén dàikuǎn, zìdòng dàikuǎn, nóngyè

dàikuǎn háishì xiàngmù róngzī? Wǒmen yǒu hǎo xiāoxī. Yuēhàn sīrén

cáiwù jīnróng, jiànlì guójiā dàikuǎn jīgòu yǐ zhīchí

shàngshì gōngsī hé sīyíng gōngsī bùmén yǐjí gèrén

gōngsī. Zhè shì wèile zhīchí quán shìjiè de jīnróng zhuàngkuàng. Yìngyòng

jīntiān dàikuǎn. Wǒmen bǎozhèng wèi nín tígōng zuì hǎo de fúwù. Nǐ de kuàilè jiùshì wǒmen de

yōuxiān. Wǒmen xiàng shìjiè gèdì tígōng dàikuǎn. Yàzhōu, àodàlìyǎ/

dàyángzhōu, ōuzhōu, běi měizhōu, nán měizhōu hé fēizhōu, nánjízhōu.

Qǐng liánxì wǒmen huòqǔ gèng duō xìnxī@:Eihoucienejohn@gmail.Com

Private Lender Bentex Funding Group Ltd.

Greetings to you by (BFGL).

We are a France-Paris based investment company known as Bentex Funding

Group Ltd working on expanding its portfolio globally and financing

projects.

We would be happy to fund and invest with you in any profitable project if you have any viable project we can finance by making mutual

investment with you. If you are interested, kindly contact us on:bentexgroup@gmail.com for more details.

Looking forward hearing from you soonest.

Yours truly,

Mrs Rose Larsson.

(Personal Assistant)

Bentex Funding Group Ltd(BFGL)

509 Rue Jacques Coeur,75008 Paris-France

Paris-France.Bentex Funding Group Ltd (BFGL)