Priority on human development, security, energy, transport

COVER STORY | ISAAC KHISA | Finance Minister, Matia Kasaija, on June 15 hit several optimistic notes for next Financial Year when announcing a Shs52.7 trillion budget.

That is a 10% jump from the Shs48 trillion last financial year and the biggest rise in projected government expenditure since COVID struck in 2020.

Kasaija appeared determined to signal a return to pre-COVID-19 positivity by reeling off measure after measure to boost the economy and said the economy is projected to grow at a rate of 6% next FY and at an average of 6.5-7% per year over the next five years.

And many budget followers and experts appear to have bought into the government’s optimism. In post-budget reading interviews with The Independent, many said Kasaija’s planned revenue and expenditures are good.

“It is a good budget. Priority areas are very strategic and important for our country,” said Pamela Natamba, a partner at the PWC.

“The money may not be enough but the allocation is a good starting point. Programs like Parish Development Model (PDM) are dear to the President’s heart but the government needs to get clear on who the beneficiaries are.”

Martin Kyeyune, Chief Corporate Affairs Officer at Roofings Group said it is time for citizens to appreciate the role of paying taxes to help government deliver services.

“Good investments in agriculture, industry, and service sectors would increase the basket in which URA has to pick taxes,” he said.

“The government has been focused on strategic areas like industrialisation which is the reason we currently have 4, 000 factories today. Strategic investments in road infrastructure mean supporting all the other sectors of the economy.”

Jonathan Tugume, the executive director at Dynacorp Limited, a construction company said the new budget is good for the population based on the increasing money allocations.

“The theme is also spot-on – the government is doing the right thing linked to monetization of the economy which means people are getting involved and goods and services can easily be traceable,” he said.

Tugume, however, said the government needs to clear arrears because they are killing the private sector and defeating the whole purpose of the local content initiative.

Like Kasaija, many commentators pushed the obvious risks under the carpet; including the increasing trend of low revenue collection by the Uganda Revenue Authority (URA), the ballooning public debt, and unpredictable weather patterns that could stifle the projected outcome.

Kasaija said the government plans to spend local revenue of Shs 29.7trillion equivalent to 14% of GDP, domestic borrowing amounting to Shs 3.2 trillion and budget support accounting for Shs 2.8 trillion.

Other funding sources include external financing for projects amounting to Shs8.3 trillion and domestic debt refinancing amounting to Shs 8.4 trillion among others.

However, the government will spend approximately Shs17 trillion in the settlement of debts including interest payments worth Shs 6.1 trillion and domestic debt financing amounting to Shs 8.4 trillion.

The country’s public debt is projected to hit Shs 88.9 trillion, equivalent to $ 23.7 billion, as of the end of June.30, up from Shs 80.8 trillion, equivalent to $ 21.7 trillion as of the end of December 2022.

Budget allocation

In terms of budget allocation, the government’s key priority sectors have remained human capital development, security, energy, and integrated transport sectors.

Human capital development has been allocated Shs 9.6trillion for the next financial year, up from Shs 9 trillion this financial year as Peace, security, governance and rule of law has been allocated Shs 9.1trillion, up from Shs 8.1trilion during the same period under review. The integrated transport sector has been allocated Shs 4.5 trillion, up from Shs 4.3 trillion.

Private sector intervention has been allocated Shs 2.4 trillion, Energy Shs 1.3 trillion, EACOP and the National Oil Company Shs 447bilion and Minerals Development Shs 54.3 billion. Payment of domestic arrears has been allocated Shs 200bn as digital transformation has been allocated Shs 192 billion up from Shs 124bn in the current financial year.

The Parish Development Model has been allocated Shs 1.1 trillion for implementation, Shs 100bn for the Savings and Credit Cooperative Societies and Shs 60bn towards the Emyooga.

The government is banking on the Parish Development Model (PDM) and Emyooga to boost household incomes as well as the development of micro-enterprises.

Since the launch of the PDM in February 2022, Shs 590.2 billion has been disbursed to all the 10,459 parishes nationwide, translating into Shs 50 million per parish.

On the other hand, seed capital worth Shs 249 billion had been disbursed to 6,721 constituency-based Emyooga SACCOs since March this year despite reports of fraud, extortion, connivance, and mismanagement by some Sacco leaders and district officials.

Taxes

Meanwhile, no major changes in tax rates have been proposed for the next financial year but new measures have been made to widen the tax base without increasing the increasing burden on the same taxpayers.

The government will effective next financial year commence rationalisations of tax exemptions to reduce revenue losses from tax exemptions. Nevertheless, tax exemption will continue based on the set criteria and assessment of costs and benefits.

Tax exemptions on deductions for accelerated wear and tear on plant and machinery as well as exemptions on VAT for diapers, inputs for processing hides and skins into finished leather; and inputs into iron ore smelting into billets have been repealed.

The Income Tax Act has been amended to allow taxpayers who obtain credit facilities from SACCOs, non-deposit-taking microfinance institutions, self-help groups, and community-based microfinance institutions to deduct the entire interest on loans from these institutions as a business expense while determining their taxable income.

This is the practice for taxpayers borrowing from commercial banks and micro-finance institutions and it is meant to enable low-income individuals and groups to access financial services and improve the profitability and survival rate of SMEs.

However, a withholding tax of 10% has been imposed on commissions paid to agent bankers to equalise their tax treatment with other agents operating similar businesses such as mobile money agents.

The VAT Act has been amended to exempt the supply of concentrates and seed cake from VAT, to incentivise local manufacturing of animal feeds and premixes; allow non-resident taxpayers to file returns and pay tax in United States Dollars to facilitate the compliance of non-resident taxpayers operating in Uganda; and require foreign remote providers of electronic goods and services to account for VAT on goods and services sold in Uganda, to bring e-commerce transactions into the tax system.

In addition, the government has also widened the scope of electronic services on which VAT is applicable to include among others, films, games of chance, advertising platforms, streaming platforms, cab-hailing services, cloud storage, and data warehousing.

In a bid to ease mobile communication across the East African Community states, the government has amended the Excise Duty Act to remove the excise duty of US$ 9 cents per minute on incoming international calls originating from Tanzania.

Uganda, Kenya, Rwanda, and Tanzania have already harmonised their calling rates within the EAC bloc enabling phone users to make and receive calls at local rates regardless of their location in what is known as the One Network Area.

Similarly, the government has lowered the capital requirement for an investor to benefit from excise duty exemption on construction materials from US$ 50 million to US$ 5 million for Uganda nationals.

However, foreign investors will be required to have investment capital of at least US$ 50 million to benefit from this exemption. The government has also slapped a 10% or Shs 75 per litre whichever is higher as excise duty on bottled water.

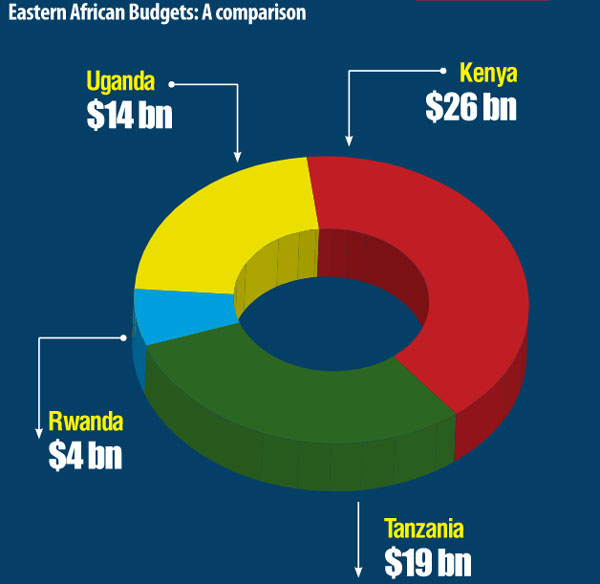

EAC budgets

Elsewhere in the East African Community states, Kenya’s budget is estimated at Kshs3.68 trillion (Approx. US$26 billion), marking an increase from KShs 3.3 trillion (US$ 23.5billion) in the previous year.

The development budget has been set at Kshs 718.9 billion, reflecting the government’s focus on infrastructure and other growth-oriented projects.

The national government has been allocated Kshs2.3 trillion, highlighting its role in driving the country’s overall economic agenda as the East African nation plans to settle part of the public debt worth Kshs1.6 trillion.

Tanzania plans to spend Tsh44.39 trillion (Approx. US$19 billion) in the next Financial Year, up from the Sh41 trillion budget. The domestic revenue is projected to be Tshs 31.38 trillion, equivalent to 70.7 % of the total budget and the deficit is filled by loans and grants.

The Tanzanian government expects to borrow Tshs 5.44 trillion from the domestic market, of which Sh3.54 trillion will be for rolling over maturing government treasury bills and bonds and Tshs1.90 trillion for financing development projects.

It also expects to borrow Tshs 2.10 trillion from non-concessional sources to accelerate the implementation of development projects.

Rwanda’s resource envelope stands at Rwf5.0 trillion (Approx. US$4 billion) for the next fiscal year, which is Rwf256.3 billion higher than the revised budget estimates of Rwf 4.7 trillion.

Domestic tax and non-tax revenues will constitute Rwf3.15 trillion, which represents 63%, external grants Rwf652.1 billion equivalents of 13%, and external loans of Rwf1225.1 billion, representing 24% of the total budget.

The country will spend Rwf 2.8 trillion, which represents 55.9% of the entire budget on economic transformation, and this includes the key areas of agriculture irrigation, inputs, animal production, and terracing. The budget will also go on boosting the value chain.

The social transformation has been allocated Rwf 1.5 trillion budget with the majority going into the construction and extension of Masaka Hospital, school feeding, and horizontal promotion of teachers.

Economic outlook

Kasaija said the economy remains resilient and is on a steady recovery path. He said the economy is projected to grow at 6% in the financial year 2023/2024 and 6.5-7% over the next five years compared to 5.5% this year.

This, he said, will be driven by increased domestic revenue mobilisation and a reduction in non-concessional borrowing to ensure debt sustainability, effective implementation of the Parish Development Model and Emyooga initiatives, and the effective implementation of the various export strategies and enhancing access to global and regional markets.

Kasaija said the size of the economy is estimated at Sh184.3 trillion, compared to Shs 162.9 trillion last year. This is equivalent to US$ 49.4 billion compared to US$ 45.6 billion last year.

He said total private sector credit increased from Shs 19.5 trillion in May 2022 to Shs 20.5 trillion in April 2023, representing annual growth of 4.8%.

He revealed that the growth in lending to industry and agriculture was 6.2% and 3.3%, respectively as trade and personal lending recorded annual growth of 14.1% and 19.1%, respectively, in the same period.

“This underscores the ongoing government interventions to ensure that agriculture and industry access adequate and affordable financing on a sustainable basis,” he said.

The country’s exports amounted to $ 4.2 billion this financial year compared to $ 3.1 billion over the previous financial year. This represents a 35.5% increase, mainly driven by an increase in exports of gold, coffee, fish, sugar, beans, maize, and light manufactured products to regional markets.

However, the country’s imports stood at $ 7.1 billion compared to $ 5.8 billion in the same period of the previous financial year owing to a rise in private sector imports, particularly in the oil and gas sector, plant and machinery for manufacturing, as well as the effect of imported inflation.

“We have recorded a trade surplus with our East African Community trading partners of $1.0 billion,” Kasaija said, adding that Tanzania remains the only EAC trading partner where the country recorded a bilateral trade deficit of $154 million.

Kasaija, however, noted that the trade balance will be strengthened further as the country continues to boost exports and enhance domestic manufacturing capacity to replace some imports.

President Yoweri Museveni, who spoke after the budget speech, said there is a need for the country to put more effort into value addition to boost the country’s export earnings as well as the local currency.

“To realise industrialisation…we don’t have to use government money. The government money has already been used on the basics like infrastructure, security, and so on,” he said. He said the government needs to court private investors to drive the industrialisation agenda.

He said there is a need to add value to maize, coffee, cotton, gold, and many others for a county to fetch higher returns.

Budget priorities for 2023/24 UGX

Human Capital Development (Ed and safe water) 9.6trn

Security, governance, legislature 9.1trn

Transport infrastructure 4.5 trn

Private sector intervention 2.4tn

Food security 2.2 trn

Energy 1.3 trn

Parish Development Model 1.1trn

EACOP and National Oil Company 447bn

Science, Innovation and Technology 257bn

Promotion of Tourism 249bn

Payment of domestic arrears 200bn

Digital Transformation 192 bn

Emyooga 100bn

Youth Skilling 60bn

Minerals Development 54.3bn

Clear outstanding medical intern arears 22.6 bn

New taxes

| No. | Current item description | Proposed item description | Current duty rate | New rates effective July 2023 | |

| 2 (d) | Opaque Beer | Opaque Beer | 20% or Shs 230 per litre, whichever is higher | 12% or Shs150 per litre, whichever is higher | |

| 3 (a) | Un-denatured spirits made from locally produced raw materials. | Un-denatured spirits, of alcoholic strength

by volume of 80% or more made from locally produced raw materials |

60% or Shs 1,500 per litre, whichever is higher | 60% or Shs1,500 per litre, whichever is higher | |

| 3 (b) | Un-denatured spirits made from imported raw materials | Un-denatured spirits, of alcoholic strength by volume of 80% or more made from imported raw materials | 100% or Shs 2,500 per litre, whichever is higher | 100% or Shs 2,500 per litre, whichever is higher | |

| 3 (c) | Ready to drink spirits | any other un-denatured spirits that are either —

(i) locally produced and less than 80% alcohol by volume |

Nil | 80% or Shs 1,700 per litre, whichever is

higher |

|

| (ii) imported and less than 80% alcohol by volume | Nil | 100% or Shs 2,500per litre, whichever is higher | |||

| 3 (d) | Un-denatured spirits made from locally produced raw materials used in the production of disinfectants and sanitizers for the prevention of the spread of COVID-19, with an alcoholic content by volume not less than 70% | Un-denatured spirits made from locally produced raw materials used in the production of disinfectants and sanitizers for the prevention of the spread of COVID-19, with an alcoholic content by volume not less than 70% | Nil | Nil | |

| 5 (b) | Fruit juice and vegetable juice (except juice made from at least 30% pulp or at least 30% juice by weight or volume of the total composition of the drink from fruits and vegetables locally grown) | Fruit juice and vegetable juice, (except juice made from at least 30% pulp or at least 30% juice by weight or volume of the total composition of the drink from fruits and vegetables locally grown) | 12% or Shs 250 per litre, whichever is higher | 12% or Shs 250 per litre, whichever is higher | |

| 5 (d) | Any other non-alcoholic beverage locally produced other than the beverage referred to in paragraph (a) made out of fermented sugary tea solution with a combination of yeast and bacteria | Any other non-alcoholic beverage locally produced other than a beverage referred to in paragraph (a) made out of fermented sugary tea solution with a combination of yeast and bacteria | 12% or Shs 250 per litre, whichever is higher | 12% or Shs150 per litre, whichever is higher | |

| 13 (g) | Incoming international calls, except calls from the Republic of Kenya, the Republic of Rwanda and the Republic of South Sudan | Incoming international calls, except calls from the Republic of Kenya, the United Republic of Tanzania, the Republic of Rwanda and the Republic of South Sudan | USD 0.09 per minute | USD 0.09 per minute | |

| 25

(b) |

Any other fermented beverages including cider, perry, mead or near beer produced from locally grown or produced raw materials | Any other fermented beverages including cider, perry, mead or near beer produced from locally grown or locally produced raw materials | 30% or Shs 550 per litre, whichever is

Higher |

30% or Shs 550 per litre, whichever is

higher |

|

| 26 | Construction materials of a manufacturer, other than a manufacturer referred to in item 21, whose investment capital is, at least USD 35m in case of a foreigner or USD 5m in the case of a citizen | Construction materials of a manufacturer, other than a manufacturer referred to in item 21, whose investment capital is at least USD 35m in the case of a foreigner or USD 5m in the case of a citizen | Nil | Nil |

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price