Future performance remains uncertain due to the ongoing COVID-19 lockdown

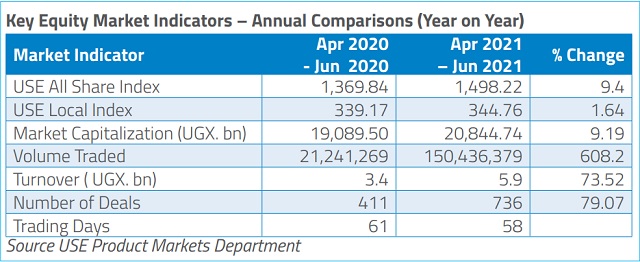

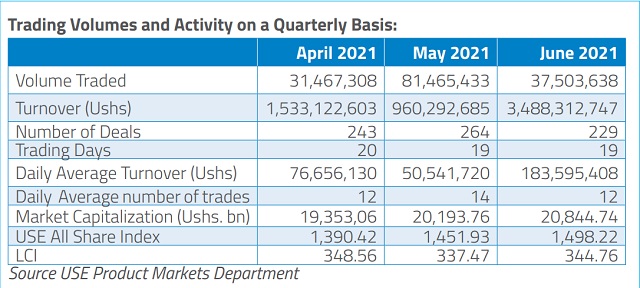

Kampala, Uganda | JULIUS BUSINGE | Stock turnover at the Uganda Securities Exchange recorded a 74% growth in the second quarter of this year to Shs5.9bn compared to the previous session as energy and banking dominated trading.

Electricity distributor, Umeme, took the first position, posting Shs3.4billion and accounting for 57.7% of the total turnover and Stanbic came second accounting for 17.4% of the total turnover.

Bank of Baroda scooped the third position with 15.8%, followed up with CIPLA and DFCU with 8% and 0.9%. The rest of the counters represented by NIC and New Vision Limited had a combined turnover of Shs1.1million.

Volume traded per counter

UCL dominated the activity during the quarter, with the counter having 85.4 million shares traded, taking 56.79% of the volume. Stanbic Uganda recorded 25.3% of the volume with 38.1 million shares, while UMEME, Bank of Baroda, CIPLA and National Insurance Corporation, posted 16.05 million shares, 10.02million shares, 677,251 shares and 104,438 shares accounting for 10.6%, 6.6%, 0.4% and 0.07% of the total volumes, respectively. DFCU, and New Vision Limited recorded marginal positions.

For bond listings, there were six treasury bonds re-opened in the quarter with a value of Shs1, 350bn which were listed. The current total value of the government bonds listed on the bourse stands at Shs18.16trillion.

However, the Corporate Bond Secondary Market remained inactive throughout the period as investors continued to hold into their investments and receive interest that is paid out semi-annually.

Currently, there are two performing bonds on the market: African Development Bank Bond which is maturing in the first two months of next year and Kakira Sugar Limited Bond, maturing in December, 2023.

Interest and lending rates

This performance during the quarter came out the time liquidity in the money markets was slightly tighter in the second quarter of the year with overall rates averaging 7.1% compared to 7% in the first quarter.

The overnight and 7-day rates averaged 6.9% and 7.4% in the three months to June 2021 from 6.9% and 7.3% in the three months to March.

Notably, money market rates came off in the last month of the second quarter in line with the revision of the Central Bank Rate to a record low of 6.5% by the monetary policy committee meeting held in June.

This expansionary monetary policy stance aimed at supporting economic recovery following imposition of a second lockdown as Covid-19 cases were on the rise.

In terms of lending rates, the shilling denominated loans increased to 19.8% in May 2021 showing a higher risk environment compared to the start of this year characterized by slow economic recovery amidst a second wave of the Covid-19 pandemic.

The lending rate as of May 2021 was higher compared to 18.8% in May 2020 and 17.4% recorded in January 2021.

Foreign currency denominated lending rates also rose to 6.8% in May 2021 from 6.5% in April 2021.

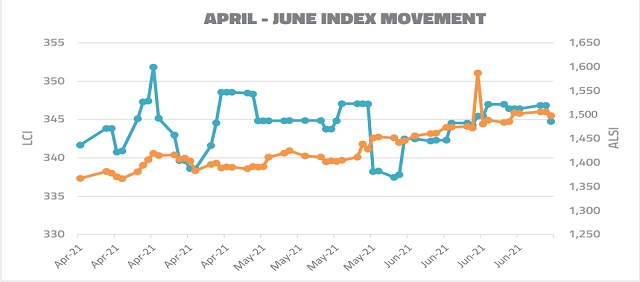

A surge in prices of some stocks such as EABL, KCB and Equity Group saw the All-Share Index opened at 1,355.12 increasing steadily to 1,451.93 in May and rising further to close the quarter at 1,498.22.

However, the local share index decreased greatly from 348.56 to a low of 337.47 in May but recovered in June to close the quarter at 344.76.

****

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price