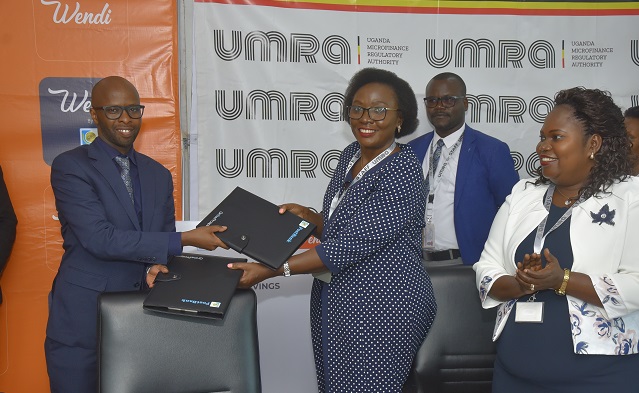

Kampala, Uganda | THE INDEPENDENT | The Uganda Microfinance Regulatory Authority (UMRA) and PostBank Uganda on 21st October 2024 signed a Memorandum of Understanding (MoU) to initiate a collaboration aimed at digitizing the operations of tier IV Microfinance Institutions through PostBank’s Wendi mobile wallet, so that the last mile beneficiary can actively participate in socio-economic ventures that will improve their livelihood.

Being at the helm of regulating the operation of microfinance institutions, UMRA’s collaboration with Wendi mobile wallet is a key milestone in enhancing financial inclusion through streamlining the operation of Savings and Credit Cooperatives (SACCOs), Village Savings and Loan Associations (VSLAs), Self-Help Groups, and Non-Deposit Taking Microfinance Institutions (NDT-MFIs)—into the digital age, thus championing sustainable financial inclusion especially in the hard to reach places where there are no physical banking facilities.

Speaking at the launch, Andrew Kabeera PostBank’s Executive Director, highlighted the bank’s dedication to fostering prosperity for Ugandans through innovative and tailored financial products.

He said, “With Wendi, we are delighted to empower individuals and groups, especially those underserved by traditional financial institutions, to access secure savings accounts, earn 10% annual interest on daily savings, and conduct various financial transactions.”

“The Wendi mobile wallet was designed by PostBank to offer seamless financial services to underserved and last-mile customers, hence users can access, manage, and transact funds efficiently. And this is both for Smartphone and feature phone users who can be both PostBank Uganda or non – PostBank customers.”

Mr. Kabeera further stated, “The partnership with UMRA is timely as it will help us boost financial literacy skills and ensure savings groups have access to essential financial services, regardless of their banking affiliation.”

A recent 2023 FinScope survey revealed a sharp increase in the adoption of SACCOs and Mobile Money services in Uganda since 2018. SACCO usage rose from 5% in 2018 to 15% in 2023, while Mobile Money usage jumped from 23% to 42% over the same period. Despite this growth, many Ugandans still store money at home, signaling a lack of confidence in both formal and informal financial service providers.

Furthermore, only 2 in 10 Ugandans save electronically, emphasizing the urgent need for digital solutions like Wendi to bridge the gap in financial inclusion. Wendi promises to offer secure and convenient financial services to help address these challenges.

Executive Director of UMRA, Edith Tusuubira made emphasis on the transformative impact this partnership will have on Uganda’s financial landscape.

“Leveraging Wendi to digitize savings groups across the country is a great initiative and we thank PostBank for taking this innovative approach because it aligns with Uganda’s National Financial Inclusion Strategy of bridging the gap of access to financial services for millions of Ugandans. By embracing digital technology, we will enhance financial literacy, security, and convenience for our people while fostering economic empowerment,”

“Therefore, UMRA commits to continuously support sector players like PostBank who have introduced services like the Wendi mobile wallet which addresses key challenges faced by informal savings mechanisms, such as: security risks, including theft or damage to physical money boxes, difficulty in tracking transactions, member contributions, balances, inefficient manual processes that are prone to errors, and vulnerability to fraud, among other involved risks, since we are trying to streamline operations as the regulator,” concluded Ms. Tusuubira.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price