By Patrick Kagenda

Will they lower the cost of phone calls?

Starting November 1, Ugandans are to be charged uniform cross-network connection or call termination fees by all telephone networks, according to the Uganda Communications Commission.

It is, however, unclear whether the stated objectives of the uniform tariff will be met.

Insiders knowledgeable about the process say most of the major telephony network players were opposed to the uniform rate. Inter-connection or termination rates are the charges which a telecommunications operator charges another for calls ending on its network, either fixed line or mobile.

If an MTN customer calls a Warid number, for example, MTN will charge the customer a fee for this call. However, Warid will charge MTN a fee for the same call because it ends or terminates on its network. This termination fee is, therefore, part of the fee MTN charges its customer.

Termination rates may be commercially negotiated or may be regulated. Uganda which operates a fully liberalised economy appears to favour a combination of negotiation and international benchmarking as its cost model.

The Uganda Communication Commission (UCC) says the new tariff framework will create a level playing field between operators and an environment in which fair competition can thrive for the benefit of the user.

Previously, the telephone operators have had to negotiate the interconnection rates amongst themselves resulting in different and higher rates. Court action has resulted in cases where such negotiations have failed.

The most recent interconnection rates have been in the range of Shs 100 to 200 per minute for calls that end users were charged between Shs 290 and Shs 320. That means that termination rates constitute between 30% and 50% of the cost of cross-network calls, which is a significant cost.

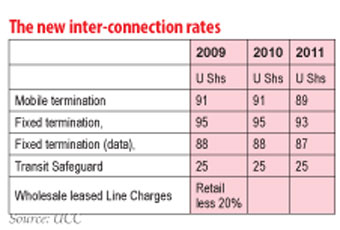

Under the new inter-connection rates, the operators will pay each other a lower rate of between Shs 88 and Shs 91 depending on whether it is data or audio being transmitted to a fixed or mobile termination and either peak or off-peak time.

However, arguments remain over the impact of uniform rates on the rate of return on investment of different players, at different levels of growth and market power, using different technologies, and coping differently with external pressures on their operations.

The accepted international best practice is to have fixed inter-connection rates. The UCC intervention, however, is a result of a PricewaterhouseCoopers (PWC) study on interconnection, retail costing and pricing. The government and UCC commissioned the study, which also recommended changes to the Uganda Communications Commission Act. Â

The high cost of calls has been a major concern in Uganda. In July, all the major telephone operators increased their rates up to 9% for MTN and Warid, and 8% to 10% for UTL.

Although the Uganda government did not increase excise duty on airtime in the 2009/2010 budget, it remains the highest in the East Africa region at 12%. Kenya and Tanzania charge 10%.

At the time of the increase, MTN chief executive officer Themba Khumalo was quoted in the press saying the operators expected a reduction in the tax and government’s refusal to lower it was resulting into pressure to raise the user fees.

The result was that for MTN customers, for example, an on-network call under the PayGo Standard increased by about Shs 20 from Shs 320 to Shs 340 at peak hours and Shs 270 to Shs 285 at off peak.

But calling other mobile networks or off-net rates under the same plan swung from Shs 480 to Shs 500 at peak time and from Shs 400 to Shs 440 at off-peak.

Experts claim the high off-net rates have in the past prevailed as a strategy by the networks to grow their subscriber base by offering lower on-net voice call termination rates.

The question being raised now is what effect the uniform rate will have on investment. This is because the higher termination rates ensured higher profits for the operators, which in turn encouraged more investments.

According to experts, other issues that UCC should look at under the new regulation include number portability across networks and a uniform call originating price. This should encourage more investments and lead to lower direct call rates.

From this perspective, it is argued that although telecoms operators are in an oligopolistic market, each has a monopolistic tendency because of near-complete control of its own network.

Each player’s significant market power on its network means it’s unlikely that they will charge a direct call below the monopoly level.

“The high call rates are not a result of interconnect rates. There are a number of factors that are responsible for the high call rates,†says Fred Masadde, the head of corporate affairs at Zain. According to him the issue of call rates is still on the table being discussed. Massade said he would, therefore, not say much about it.

For example, despite the different packages the telecoms companies have for their clients, new entrant i-Tel charges a flat rate of Shs 200 across all local networks at peak time while the rate is 220 at off peak period. This is far lower than the rates for the older networks.Â

Unless the government influences the direct calling price, experts warn, the effect of the uniform call termination rate could be missed.

Minister for Information Communication Technology (ICT) Aggrey Awori says the uniform rates are aimed at harmonising call charges in all the five East African member countries.

“These new rates will lower the call tariffs for phone users. With the arrival of the Fibre Optic Cable things are going to be much cheaper,†he said, “In Kenya the government  actually forced the telephony companies to cut the rates but in Uganda we discussed with our companies to come to an agreement.â€

The EAC, under the East African Regulatory Post and Telecommunications

Organization (EARPTO) and the formation of the East African national working group to harmonise ICT policies, is developing a regional interconnection framework for public networks and services providers.

Since 2002, proponents have argued that EAC countries need similar interconnection principles, policies, and cost-based and efficient rates to ensure affordability to users and universality.

According to the April 2008 EARPTO guidelines on interconnection and access for telecommunications networks and services within the EAC, Apart from Tanzania which studied and fixed rates at US cents 9, Uganda and Kenya had not as January 2007 done costing studies that reflected realistic interconnection rates.

As a result, the EARPTO report recommended that the East African termination rate should have a cap of 12 US cents for both fixed and mobile termination, (at least 3 US cents above the cost based mobile termination rate of 9 US cents). This should ensure that mobile and fixed operators are able to handle each other’s traffic and the possibility to negotiate a lower rate when there is a business need.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price