Kampala, Uganda | THE INDEPENDENT | Doris Akol, the Uganda Revenue Authority-URA Commissioner General, has recalled the order that required individuals and corporations transferring sh50 million and more abroad to have a tax certificate.

The order, which became public on Wednesday and had been issued by Commissioner Domestic Taxes Henry Saka, had raised eyebrows among entities and individuals in the financial sector with some saying the threshold was small. They also complained that requiring tax certificate means an extra layer of bureaucracy.

Commercial banks and other money remitting companies were expected to implement the order immediately.

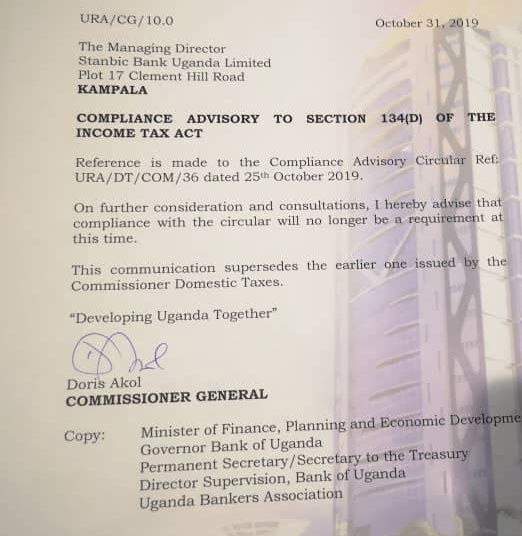

Thursday night, Akol said in letter that “on further consideration and consultations, I hereby advise that compliance with the circular will no longer be a requirement at this time.”

The letter is copied to the Minister of Finance, Governor Bank of Uganda and the Uganda Bankers Association.

Uganda has a free capital account system where an investor can bring in money and take it out whenever they want but experts argued that if the directive that everyone transferring sh50 million and above get a tax certificate, it would have helped the tax body catch tax thieves.

However, depending on how swift the process of acquiring the certificate would be, experts feared it would also make Uganda a hard place to transfer money which is a cost of doing business.

*****

URN

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price