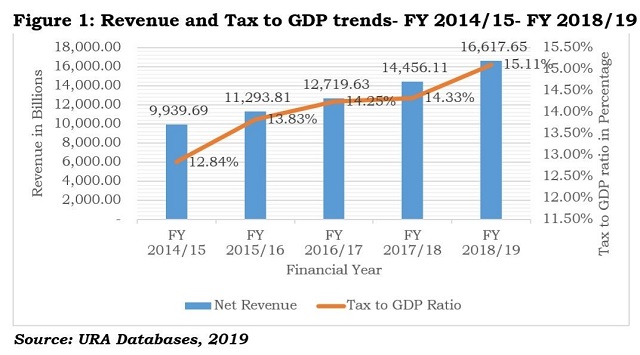

Kampala, Uganda | THE INDEPENDENT | Uganda Revenue Authority collected 16.6 trillion Shillings, much more than it had estimated in the just-ended financial year. Against a target of sh16.4 trillion, the tax body registered a surplus of sh259 billion, the biggest in its entire history.

Compared to the 2017/18 financial year, these numbers show tax revenue grew by a whopping sh2.2 trillion, a growth of 15 per cent.

At the regional level, Uganda performed better than all partner states with 15 per cent growth in revenue. It is followed by Rwanda with 13.3 per cent, Kenya 11.3 per cent, Burundi 9 per cent and Tanzania at just 2 per cent.

The numbers indicate a vote of confidence on the Ugandan economy but also a reward to URA’s aggressiveness to get more taxpayers on the register and ensure that they actually pay. Government has indicated that the economy grew by 6.2 per cent last financial year.

URA Commissioner General Akol told reporters at the URA headquarters in Nakawa today that the steadily growing revenue performance is a major achievement for Uganda.

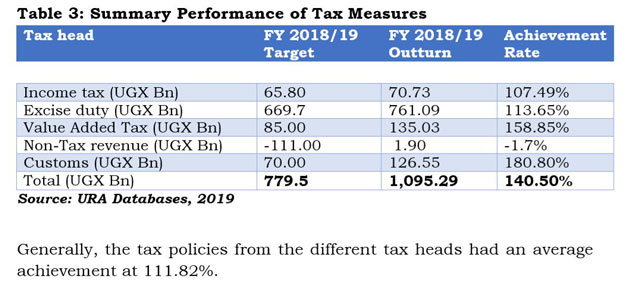

The tax sectors that show health in income – including corporation tax (levy on company profits), Pay as You Earn (PAYE), which is levied on employees’ earnings – performed above target. This means that companies made money and hired more staff.

Akol said those that laid-off workers were insignificant and could not affect the collections.

This, she said, is in line with independent surveys, including the Purchasing Managers Index (PMI), which showed last month that businesses were hiring more people, increasing their output in response to increasing demand.

On the tax to GDP ratio, which is the portion of nation’s tax revenue relative to its gross domestic product (GDP), or the market value of goods and services a country produces, grew to 15 per cent – which is still below the region’s average of 16 per cent.

Akol said that in particular last financial year saw this number grow above the International Monetary Fund (IMF) recommendations.

URA is expected to collect 20.3 trillion Shillings this financial year. The tax revenue will be 18 trillion Shillings while non-tax revenue, including tuition for public universities, will make up the reminder. Akol said URA will mostly use enforcement measures to realize this tax, including use of ‘digital tax solutions’ supplied by SICPA.

*****

URN

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price