By Joseph Were

As it enters the last quarter, the Uganda Revenue Authority is set for a new record in net collections despite a general cloud over the economy.

Compilation of its third quarter (Q3) figures must still wait for the March figures but projections based on January and February indicate a growth in net collections compared to last year.

Monthly performance, however, remains hot and cold. Therefore, URA could still fail to hit its Shs 3,994.5 billion target for the year ending June 2009.

In a statement last week, URA said its net collections picked up in February to Shs 310.10 billion well above its monthly target of Shs 290.67 billion.

But these positive figures follow poor performance in Q1 and Q2 (July to December 2008) that saw the tax body register a Shs 108.07 billion shortfall in collections.

It netted Shs 1,719.88 billion against Shs 1,827.95. Compared to the Shs 1,498.91 netted over the same period the previous year, the 2009 target represents a projected 20% growth in collection for the half year.

Although perfectly acceptable when it was set early last year it now appears ambitious.

At the time, Uganda’s commodity exports sector, tourism, and portfolio investment inflows were booming.

Today, however, Uganda’s economy is reeling from the effects of the global economic crisis. Growth projection has dropped from 8.1% to between 6 and 7% with equally gloomy projections for aggregate corporate profitability, consumer consumption behavior, a depreciating shilling and tighter-fisted banking sector.

| FASTEST GROWTH

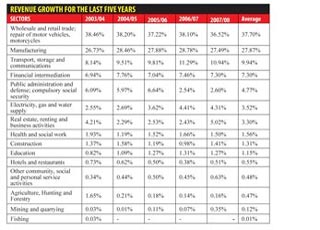

Wholesale and retail trade; repair of motor vehicles, motorcycles had the fastest growth over the last five years with an average of 37.7 % the highest growth was recorded in FY 2003/04 with 38.46 % and in the following years growth has been fluctuating downwards as presented above. Manufacturing this sector had the second highest growth with an average of 27.87% over the last five years, the highest growth was in FY 2006/07 with 28.78%, and fluctuations downwards were recorded as seen in the table. Transport, storage and communications this sector has the third highest growth with an average of 9.94%, the highest growth was recorded in FY 10.94%, this is sector has significantly exhibited increasing trends in growth, with communication contributing the highest revenue. Financial intermediation this sector has the fourth highest growth with an average of 7.30%, the highest growth was recorded in FY 2006/07 with 7.46%. |

As expected the URA statement last week warned that the below par economic growth will automatically boomerang on revenue performance. The question is how badly. For a start now all tax bases are underperforming.

In February, corporation tax, individual income tax, rental income tax and casino tax under performed. In total, indirect domestic tax registered a shortfall of Shs 10.30 billion due to deficits in excise duty and VAT as the breweries, soft drinks, and cement sectors took a hit.

Major companies registered lower profitability than projected due to increased investment expenditure in expansion projects, network upgrades, new plants, powerlines. In December alone, seven companies expected to pay Shs 1.28 in taxes paid only Shs 28.45 billion. The December 2008 withholding taxes from Dividends and Management fees also registered a 37% decline in collections compared to December 2007.

Revenue from tax on fuel products registered a shortfall of Shs 33.71 billion due to reduced import volumes.

Volumes grew by 3.99% but remained lower than the projected 5.0% partly due to the axle weight limit for trucks from 4 axle to 3 axle imposed by Kenya, the strikes by the shipping lines and clearing agents at the port in Mombasa and the supply constraints in oil the pipeline from Kenya. Revenue growth on Diesel was lower to 3.13% and Kerosene to -4.27%.

| All graphs from Uganda Revenue Authority |

But direct domestic taxes (PAYE, Withholding tax and Tax on Bank Interest) and excise tax on telecoms registered surpluses. The increased importation of inputs in the telecom sector reflects continued confidence in the economy and international trade taxes were up by over 100%.

Stellar performance on the international trade counter could boost URA’s performance further because of the continued depreciation of the shilling against, especially the US dollar.

The shilling, which has been on a downward spiral since mid-last year took a major drabbing last week plummeting to an all time low of Shs 2,050 to the dollar.

The exchange rate used for tax purposes has equally been depreciating.

However, international trade collections have continued to grow slightly higher than the growth registered in dollar appreciation.

In a written statement to The Independent, the URA cautioned that international trade taxes could be affected by imported inflation. This could offset the impact of the dollar appreciation on tax revenue collection figures as increased cost of imports results in lower quantities, while taxes on major trade items like fuel are specific and not ordinarily affected by exchange rate movements.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price