Falling market performance

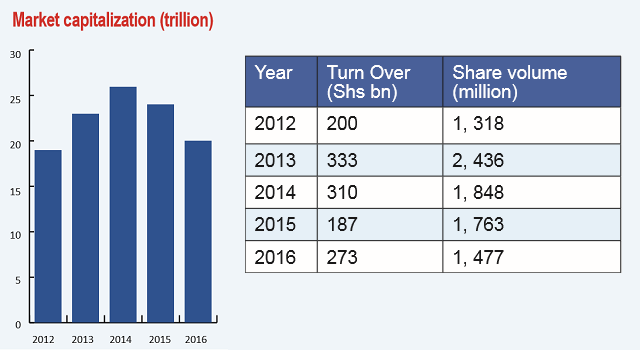

Data from the USE shows that market capitalisation dropped by Shs4trillion to Shs20trillion last year, down from Shs24trillion in 2015, and Shs 26tirllion in 2014 as the bear run continued a head of unveiling lower company performances. In 2013, market capitalisation stood at Shs 23trillion.

The equities market opened the year (2016) with all share index at 1,763 but declined most of the first quarter dropping to 1,742 in March.

It rebounded modestly in the second quarter closing at 1,763 in June before sliding to 1,454 in September and closing at 1477 in December, representing an overall decline of about 16%.

USE Chief Executive Officer Paul Bwiso told The Independent in an interview that the decline in performance was attributed to a large drop in prices of large counters especially of cross-listed companies from Kenya resulting from the recently introduced caps on interest rates.

Last year, Kenya amended the Banking Act requiring lenders to peg credit costs at 400 basis points above a benchmark central bank rate and also compels financial institutions to pay interest of a minimum of 70% of the same rate on deposits.

“On the whole 12 counters declined while four counters advanced in value,” Bwiso said, adding that the effects of the February 2016 general election also impacted negatively on the market as investors had to temporarily withhold their cash to study the peace situation in the country.

For instance, Nation Media Group lost about 51% of its value during the year joined by regional lender, KCB that lost 24%. EBL lost approximately 19% of its value compared with the beer maker East African Breweries Limited’s 10% during the same period under review.

Bwiso said the decline in the local share index was mainly due to declines in prices of electricity distributor Umeme that lost 22%, followed up closely by Stanbic Bank Uganda and New Vision limited that lost 21% and 10% of their value respectively.

In terms of equity turnover, a key performance indicator realized throughout the year was Shs 273billion from the sale of 1.5 billion shares last year compared with Shs 187 billion turnover realized from the sale of 1.7 million shares in 2015.

The equity segment was dominated by Umeme and Stanbic accounting for about 93% of the total turnover. The only cross listed counters that traded were CENTUM and Equity Bank Limited.

Local counters dominated trading throughout 2016 accounting for over 99% of the total turnover and volume. The turnover grew by 46% relative to a value of 187 billion that was realized in 2015. The volume on the other hand grew by 69% relative to a volume of 889 million that was realized in 2015.

Reforms to improve performance in 2017

But Bwiso says he remains optimistic that things will get better this year on the stock market.

“It is a fact that our market is not performing the way it should,” he said. “We expect to implement reforms that will boost market activity starting this year.”

The reforms, he says, includes; public awareness campaigns on the benefits of the stock market, encouraging the small and medium enterprises to list, in addition to other large companies coming onboard, engaging government to offer some incentives to the would-be potential companies to list, and also urging players to use the electronic trading system that started towards the end of last year.

Over the years, Ugandan firms have been reluctant to go public as most privately and family-owned businesses fear losing their control and public scrutiny.

Financial analysts are in agreement with Bwiso’s big plan but insist he has to be practical.

“New listings boost market activity anywhere in the world,” Nsiko said.

Currently, USE has 16 listed firms compared with 21 on the Dar es Salaam Stock Exchange and 63 on the Nairobi Stock Exchange.

****

editor@independent.co.ug

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price