The Independent reported in May that President Museveni was looking to deal with ‘simboxes’ by procuring a technology that will also enable government to eavesdrop in on international calls.

The technology that will cost the Ugandan taxpayer between $20-30 million (Shs 66 – 99 billion) is also expected to, for the first time, enable the country to monitor the voice and data traffic of telecoms.

While Uganda has technology capabilities to eavesdrop in on local calls, international calls have been off its radar. Aware of this, some opposition politicians and Ugandans with sensitive information have been using international lines, thereby, minimising risks of local eavesdropping.

Since telecoms started operating, they have been doing what is called self-declaration to the sector regulator, the UCC. As such, UCC has only been levying fees on them basing on what the telecoms say they earned.

UCC collects an annual levy on telecoms gross revenue of 2%. The levy is too critical – it constituted 27% of the commissions projected revenues in the financial year 2014/2015. And UCC is required to remit 1% of this levy to the Consolidated Fund.

However, in his 2015 report published this year, the Auditor General, John Muwanga, added his voice to those that have raised a red flag on the fact that the regulator relies on the operators audited financial statements to raise invoices of the 2% levy on the revenue.

“A review of the revenue collection system revealed that [UCC] has not yet built capacity to independently verify the revenue figures reflected in the operators’ audited financial statements to counter the likelihood of audit risk/ or collusion,” the report reads, “As such, there is a risk of under collecting revenue for the Commission in the circumstance.”

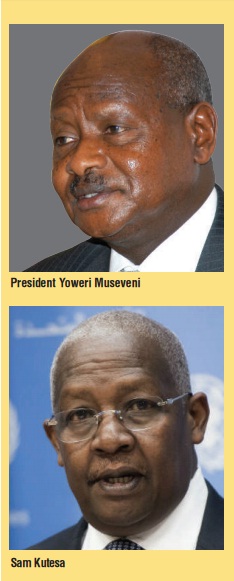

A month-long investigation by The Independent revealed that the procurement of the INMS, which is expected to also deal with this, was for years kept off the table because of an intense fight between Uganda’s major procurement brokers over who gets the deal until President Yoweri Museveni intervened. At some point, top Cabinet officials like Amama Mbabazi and Sam Kutesa were involved in fighting for the deal. Agents close to Kutesa were fronting a company called N-SOFT while those close to Mbabazi were fronting Global Voice.

The jostling was because operating the INMS is big business. And this is partly why telecoms were opposed to the procurement.

In other countries like Ghana and Rwanda where the INMS is operating, it is being run as a Build Transfer and Operate (BoT).

In these countries, the operator of INMS levies a charge of say one cent per call. To get the picture of the monies involved, let us say a telco like MTN terminates 200 million calls a month. That is 2,400 minutes. In five years, those are 12,000 minutes. The operator usually gets a consession of five years.

To solve the issue, President Museveni reportedly brought on board Josephine Wapakhabulo, the daughter to the late James Wapakhabulo, who was Uganda’s speaker, foreign affairs minister and Deputy Prime Minister.

At the time The Independent published this story, Josephine was abroad. She has since returned but has not yet zeroed in on the company. We were unable to reach her for a comment by press time as her known number was off.

Critics, however, say that the INMS will not solve the simboxing fraud, in which, the kingpins happen to be major players in the telecom sector, senior officials in cabinet and some Chinese dealers. What is possible, critics say, is minimizing its extent.

With this, the regulator, Mutabazi says, the telecoms themselves have a major role to play in exposing the dealers given that the calls are terminated locally and the operators have capabilities to reveal who they are.

But he was quick to add his voice to the many who have said that the problem is that some of the players in the sector also happen to be accomplices in the fraud.

Against that background, some think that the shareholders also felt that the MTN management under Gouldie has not provided the leadership befitting of a market leader. They hope that the situation would change with a strong and more aggressive CEO at the helm.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price