Fred Muhumuza, a Development Economist says the suspension of new money is likely to affect Uganda’s Country Policy and Institutional Assessment(CPIA) Score which investors and donors base on to determine the amount of funding to give a particular country. The Uganda CPIA score has since 2012 been above average at around 3.7 on a scale of 0-5. The average for Sub-Saharan Africa is 3.1 on the rating which is generated by the World Bank. Now, however, Muhumuza says Uganda’s score might decline and investors and donors may reduce the amount of lending Uganda receives.

Muhumuza added that Uganda has been suffering with dollar scarcity recently and the money the bank is withholding is in dollars. Muhumuza says this will push dollar scarcity up and may cause the exchange rate to spike.

Another effect could be that since the economy has, according to some economists been in a recession since 2013, the infrastructure investment has been looked at as economic stimulus. Without it, the economy might take longer to recover.

Tough Calvo pounces

The withholding of new lending is the third disciplinary step the Bank is slapping on the government of Uganda’s road sector in the last six months.

In December 2015, the Bank cancelled US$265 million in funding for the Uganda Transport Sector Development Project (TSDP) over alleged “contractual breaches regarding workers, social environmental concerns, poor project performance, and serious allegations of sexual misconduct by contractors”. At the time the Bank’s drastic action was described by observers as a “rare move”.

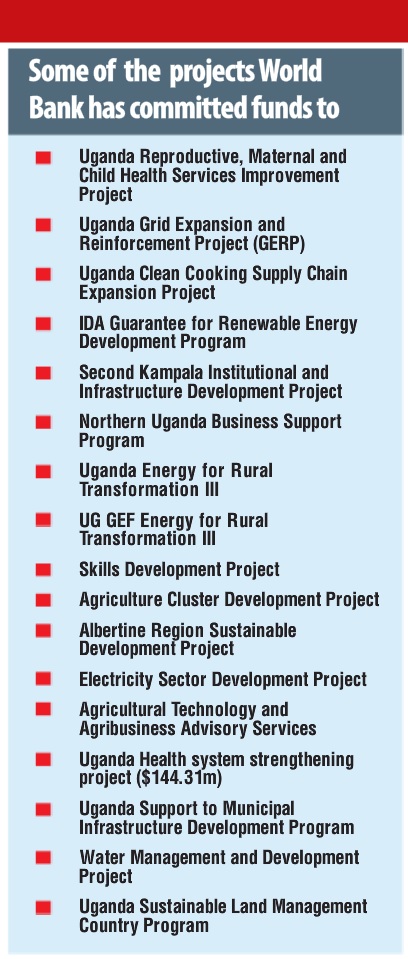

However, on Jan. 8, the Bank struck again, this time suspending funding for two projects; the US$255 million North-Eastern Road Corridor Asset Management Project and the US$153 million Albertine Region Sustainable Development Project. That is US$673 million (Approx.Shs230 billion) pulled out of the transport sector budget which for the 2015/16 national budget was Shs3.3 trillion.

The Bank demanded that the government strengthens UNRA’s capacity to supervise. With the appointment of a new no-nonsense, Executive Director Allen Kagina at UNRA, the government appeared to have complied with this demand. Kagina has a result-oriented corruption free track record cultivated from her years at the Uganda Revenue Authority (URA). But the World Bank appears unimpressed.

The Kamwenge-Fort Portal road remains at the centre of the Bank’s punitive actions.

Apparently, communities in the area had complained that the contractors were involved in sexual activity with local women and under-age girls. The government immediately stepped in with remedial action and up to 36 cases of sexual assault were filed and investigated.

By September 2016, several cases had been pursued in courts of law and convictions were made in three cases. Two cases are ongoing in the court, and one awaits sentencing. The contractor is the Chinese firm, China Railway Seventh Group, while the World Bank is American-dominated.

Despite the corrective actions by the government, the World Bank appears determined to either fix or cripple the government’s ambitious infrastructure projects. In this sense, Calvo’s arrival in Uganda appears to have been made with specific goals in mind. Calvo is highly experienced in overseeing road infrastructure projects.

She received the International Road Federation’s Professional of the Year award in 2005 and has worked on infrastructure services and sustainable development in Africa, East Asia and the Pacific, and Latin America and the Caribbean. She was Lead Economist in the Transport sector, Country Manager in Dominican Republic.

The Swedish national is also quite familiar with Africa. In the mid-1980s, she lived and worked in rural Tanzania. This experience may have shaped or engendered her passion for fighting poverty. She was part of the core team for the World Development Report on Poverty in 2000 and was once the manager at the World Bank for the Poverty Global Practice in the Middle East and North Africa and South Asia regions. Calvo is also very experienced in her job, having been with the Bank for over 20 years. No wonder, it appears Uganda’s finance sector players are in awe of her.

Despite repeated efforts by The Independent to get a comment from the Permanent Secretary/ Secretary to the Treasury, Keith Muhakanizi or the Director of Budget at the Ministry of Finance, Kenneth Mugambe, none was forthcoming. That was another sign that the World Bank move is hot coals and nobody wants to get burned.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price